Innovation-abm: an agent based model of innovation creation and diffusion

Daniele Ietri and Marco Lamieri*

October 2004

*“Dipartimento Interateneo Territorio, Politecnico e UniversitÓ di Torino”

(

ietri@econ.unito.it) and “Dipartimento di matematica e statistica applicata

alle scienze umane Diego De Castro, UniversitÓ degli studi di Torino”

(

lamieri@econ.unito.it). Piazza Arbarello 8, 10122 Torino Italy

|

Market is the only result of the behaviour of agents, as we can

find other forms of contact and communication. Many of them are

determined by proximity conditions in some kind of space: in this

paper we pay a particular attention to relational space, that is the

space determined by the relationships between individuals.

The paper starts from a brief account on theoretical and empirical

literature on social networks. Social networks represent people and

their relationships as networks, in which individuals are nodes and

the relationships between them are ties. In particular, graph theory is

used in literature to demonstrate some properties of social networks

summarised in the concept of “Small Worlds”. The concept may be

used to explain how some phenomena involving relations among agents

have effects on multiple different geographical scales, involving both

the local and the global scale.

The empirical section of the paper is introduced by a brief

summary of simulation techniques in social science and economics as a

way to investigate complexity. The model investigates the dynamics of

a population of firms (potential innovators) and consumers interacting

in a space defined as a social network. Consumers are represented

in the model in order to create a competitive environment that

pushes enterprises into innovative process (we refer to Schumpeter’s

definition): from interaction between consumers and firms innovation

emerges as a relational good.

|

Contents

List of Figures

1 Introduction

In this paper

we focus on both innovation and its relational properties. The simulation model

presented investigates the dynamics of a population of firms and consumers

interacting in a relational space, defined as a social network. Consumers are

represented in the model in order to create a competitive environment pushing

enterprises into innovative process (we refer to Schumpeter’s definition): from

interaction between consumers and firms innovation emerges as a relational

good.

In section 2 a Schumpeterian definition of innovation is introduced and

we present some insights on the role of knowledge and relations in the

innovative process of firms. Section 3 starts from a brief account on theoretical

literature on social networks and graph theory. Social networks represent

people and their relationships as networks, in which individuals are nodes

and the relationships between them are ties. Moreover, graph theory is

introduced in order to represent the network, which will be populated of

both firms and consumers. Finally, the “small worlds” phenomenon is

presented and implemented as an algorithm useful to define how relationships

are formed. Finally a model drawn from literature is presented as an

example.

The empirical section of the paper is introduced by a brief summary of

simulation techniques in social science and economics, as a way to investigate

complexity. The model is then presented, with a detailed description of its main

features. In conclusion of the paper, some early results of simulation runs are

presented and discussed.

2 Firm and innovation, knowledge and networks

In this section we will provide a brief account of part of the theoretical

debate on the role of innovation in the economic system. We will try to

demonstrate, always from a theoretical point of view, why innovation is mainly a

matter of relations and why we need to study networks of firms with our

model.

2.1 Innovation, firm and economic growth: the schumpeterian heritage

The theories of economic development of “neo-classical” origin (or, as is often

said, mainstream) have often considered technological innovation as a simple

factor in a production function. Nevertheless Karl Marx in his “Zur Kritik der

politischen Íkonomie” (1859) recognised in the technical progress the main reason

for development. According to the German economist, in fact, competition forces

entrepreneurs into the innovative process, which consists in the exploitation of

what is made them available by science.

The role of innovation has been studied in-depth by Schumpeter (1934), who

focused in particular on the role of the entrepreneur. Schumpeterian entrepreneur

is characterised by exceptional qualities of force and sharpness and is the real

author of the innovative process, as she is able to introduce innovations in the

productive processes. Schumpeter’s model formalises three steps of the innovative

process. First, the invention, that applies to the outcome of research activity.

Second the innovation itself, that occurs when invention is applied in

the productive process. Third, imitation, that is the attitude of other

entrepreneurs who imitate other’s invention. In schumpeterian approach

innovation is the re-organisation of productive factors in new combinations:

the outcomes may concern the introduction of a new good or productive

process, the opening of a new market, the discover of a new source of

primary goods, the emergence of a new form of organisation of the firm

.

Innovation has characteristics of a “creative disruption” force, as it determines

the rise of new activities and productive sectors to the detriment of old sectors

and technologies. Moreover, the nature of the innovative process itself, as

described by the Austrian economist, based on a perpetual dynamics of innovation

- imitation - innovation, is cause of economic growth and mostly of the cyclical

instability of the economic system. Innovation, in fact, is introduced by few early

adopters and is diffused in the system by the imitators. In the aggregate

dynamics of the model presented in this paper we will look for those cyclical

behaviours: we will test if a sort of “bangwagon effect” as described by

Shumpeter

will emerge from the simulation.

The schumpeterian approach inaugurated a long lasting theoretical

debate: some recent works of the economists of the so called Austrian

school are interesting for our theoretical framework. In particular the

writings of Friedrich Hayek are fundamental for the attention they pay

to the role of technical development and knowledge in the firm (Hayek,

1937). The main role of information and its transmission and diffusion

dynamics is underlined by Hayek in a paper in which he explains how

people keep specific pieces of knowledge, which are uneasily transferable to

others.

2.2 Knowledge, interaction and the innovative process

The ways in which knowledge is produced and diffused play a fundamental role in

the innovative process. Knowledge is often part of the know-how peculiar of a

subject or an organisation. In order to define the framework for the simulation

model presented below we will briefly present some definitions of knowledge and

hypothesis on its diffusion dynamics.

Knowledge is very heterogeneous according to its nature and scope: it can be

very abstract or applied, it can be used in a very technical or general way

(both engineering and philosophy are forms of knowledge). According

to the way it is diffused, Polanyi (1967) individuates two main kind of

knowledge:

- codified knowledge: easily transferable and accessible to everyone who

knows its specific language (or code), it can be sold or appropriated

(i.e. through patents);

- tacit knowledge: is embedded in an organisation or community, it can

be transferred only through personal relations and it can’t sold.

If we admit the existence of a such kind of knowledge we recognise that

at least part of the knowledge involved in the innovative activities of

firms has a tacit nature. As this kind of knowledge can be transferred

through personal relations, innovation becomes a relational activity, in

which relations and proximity between firms are needed. Relationships are

then necessary in order to allow external knowledge to be used in the

productive processes inside the firm, especially when tacit knowledge is

involved. Imitation is possible, but many relationships are needed in order

to internalise processes taken from the activities of other firms: this is

why in our model firms would be able to imitate only the most diffused

goods.

More in general, innovation and the production of knowledge is

a “localised” process: proximity matters, in relational and spatial

terms .

That’s the reason for the use of social networks in order to investigate innovation

dynamics among a population of firms.

3 Firm and relationships: small worlds and social networks

In this section we introduce a more methodological issue: if we investigate

relations, a topological definition of relationships is needed in order to build a

simulation model. The necessary theoretical background is defined by three main

concepts:

- social networks, as a field of research that has studied in-deep the form

and dynamics of the relationships among people. We will simply draw

some concepts from literature and apply them on the relations between

firms;

- graph theory, as a way to represent topologically networks and define

measures useful to get some of their main characteristics;

- “Small Worlds” phenomenon, from which we derive a theoretical

framework (and an algorithm) in order to simulate the creation and

dynamics of relationships between agents.

3.1 Social networks: why the world is a “small” world?

Some features of social systems may be studied through the theoretical framework

of physical systems. As an example, the notion of distance typical of physical

systems can be adapted in order to suite the characteristics proper of relationships

between people. The use of distance reveals also some critical difference

between the two systems. A fundamental property of physical systems is

that randomly chosen three points in the space and connecting them by

segments we form the sides of a triangle. The sum of the length of the

two sides is always greater than the measure of the third side. In social

systems the concept of distance can be used to represent the strength of the

relationships intertwined between people. The smaller is the segment

connecting two agents, the strengthen will be their relationships. Social

systems violate the triangle property: a subject may in fact entertain

very strong relationships (the segments connecting her acquaintances are

very short) with two subjects that do not share any relation (there’s no

segment connecting them). An individual may belong to separate groups of

acquaintances among which there’s no relation: in this case the subject is the only

connection between the two groups. We will call those distinguishable groups

of acquaintances clusters: they are for examples the family, groups of

friends, colleagues and other groups in which people participate for different

purposes.

The “Small World” phenomenon is part of the studies on social networks. In a

social network, individuals are represented, conceptually and graphically, as nodes

of networks formed by the subjects themselves and the relationships connecting

them.

Theories are not easy to test on large networks and with diffuse connections,

as the computational work increases with the raise of the population. Social

networks show non local properties so that it’s not possible to analyse global

features using exclusively local analysis.

We should not regret that the empirical analysis is made difficult as

people hardly are able to take account of their own contacts, if not with

methods requiring time and hard work. Each research is finally particularly

conditioned by the given definition of friend or acquaintance, which may

vary from knowing other person’s name to relationships involving mutual

trust.

As the critical questions exposed above showed, researches on these

topics encounter many difficulties, in particular on the empirical point of

view.

3.2 Graph theory

In order to represent social networks and the Small Worlds phenomenon we

should briefly introduce some concepts of graph theory, following Watts (1998).

We will define graph any set of points (vertexes or nodes) tied by lines (links or

edges). The number of points defines the order of the graph, while the number of

lines defines its dimension. Some properties of graphs useful for this work

are:

- the characteristic path length L, defined as the median of the means

of the shortest path lengths connecting each node to all others nodes:

randomly chosen two subjects in the social network, we can expect

being L the length of the shortest path between them;

- the cohesion d, the probability that nodes linked to any defined node

would be connected to each other . This property is also defined

clustering coefficient and is the ratio between the number of edges in the

neighbourhood of a node and the total number of theoretically possible

edges in that neighbourhood. It is a proxy of the tendency for a graph

of forming clusters, sub-groups of nodes.

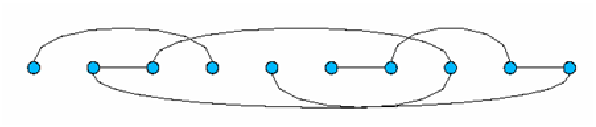

Thanks to the analysis of graphs itis possible to study the relations between

local and global level of the network. At the local level the graph has nodes

connected in a way determined only by the neighbouring conditions, with each

node linked to its neighbouring nodes: in Figure 1 this condition is graphically

presented.

If the edges are randomly determinate we obtain a random graph (global

graph), represented in one-dimension in Figure 2.

If nodes represent the agents and graph formed by nodes and ties represent

social networks, then we justify the use of terms such as “local” and “global”. In a

structure such as the one of the regular graph, each node (agent) is able to

interact only with the k agents forming its neighbourhood: the space determines

the possibility to interact of each agent that may operate only in a local context.

The agents interacting in a random graph may establish relationships apart

from the spatial structure of their neighbourhood, acting in a pure global

scale.

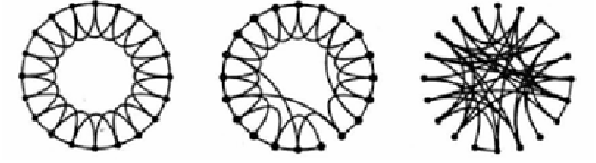

3.3 Small worlds: networks between order and chaos

Defining from end to end the possible structure of graphs, on one end

one-dimensional structures perfectly correlated and on the other multi-dimensional

structures perfectly un-correlated, we can explore (Watts, 1998) the intermediate

configuration, looking for “small worlds” graphs, characterised by high levels of

both accessibility and cohesion.

We take into consideration, apart from the sociological meaning of the

network, a circular structure that, varying a parameter  gradually changes from

a determined graph into a completely random graph (Figure 3). Watts (1998)

presents some results with respect to characteristic path length and clustering

coefficient measures. When

gradually changes from

a determined graph into a completely random graph (Figure 3). Watts (1998)

presents some results with respect to characteristic path length and clustering

coefficient measures. When  is very small (

is very small ( = 0.01) the characteristic path

length gets immediately lower, while the clustering coefficient lowers only for

higher levels of

= 0.01) the characteristic path

length gets immediately lower, while the clustering coefficient lowers only for

higher levels of  (

( = 0.1). In the interval (0.01 <

= 0.1). In the interval (0.01 <  < 0.1) the graph presents

both cohesion and accessibility.

< 0.1) the graph presents

both cohesion and accessibility.

The accessibility of the network increase while the  parameter increases and

is due to the way in which ties are recalculated. If the number k of connections is

fixed, while

parameter increases and

is due to the way in which ties are recalculated. If the number k of connections is

fixed, while  increases the dispersion of ties grows.

increases the dispersion of ties grows.

For low levels of  , new ties connect two nodes which already share a

neighbourhood with a third one: a triangle is formed and the path within

them is scarcely reduced. We will define this feature as a “shortcut”.

While

, new ties connect two nodes which already share a

neighbourhood with a third one: a triangle is formed and the path within

them is scarcely reduced. We will define this feature as a “shortcut”.

While  grows new ties will instead connect very distant nodes that do

not share their neighbourhoods. In this way the new links created will

connect groups of agents, reducing the characteristic path length of the

network.

grows new ties will instead connect very distant nodes that do

not share their neighbourhoods. In this way the new links created will

connect groups of agents, reducing the characteristic path length of the

network.

Parts of the graph and groups of nodes which otherwise would be separated

are connected thanks to this feature. A few shortcuts are needed in order to

obtain a sensible reduction of the characteristic path length: in fact, it lowers

immediately for low levels of the  parameter.

parameter.

The implementation of graph theory in order to explain the innovation

diffusion is a fertile ground of study; for example Cowan and Jonard (1999) focus

on knowledge diffusion through face-to-face relationship and on the relationships

developed on networks structures. It is assumed that subjects are part of a

network and detain various kinds and amounts of knowledge. For each step one of

the edges of the network is randomly chosen and the subjects connected by that

edge compare their knowledge. If for example one of them detains more

knowledge of the kind a and the other of the kind b they get involved in an

exchange of knowledge. The parameter in the model is the probability

p that a link is destroyed and re-wired. For p varies, the measures of

characteristic path length and cohesion are calculated: for p included between

0.005 and 0.01, the model shows high cohesion and low characteristic

path length. Cowan and Jonard measure the medium level of knowledge

detained by each subject: the level is particularly high in the same interval

(0.005 < p < 0.01). We may say that cohesion and path length act in

opposite directions: cohesion is responsible for a quick diffusion among

neighbours (at local level) while path length shows how information (or

innovations) is able to reach and diffuse far from the point in which have been

originated.

4 An agent based model on innovation creation and diffusion

The analysis of innovation diffusion within a social network present some

analytical difficulties, due to the emergence of global properties not predictable on

the basis of local interaction. Computer simulations seem to be suitable

in studying those phenomena, which undoubtedly present elements of

complexity.

4.1 Simulation techniques for social sciences and economics

According to Langton (1992) one of the fundamental aspects in the analysis

of complex phenomena is the distinction between linear and non-linear

systems.

Dealing with linear systems the behaviour of the whole system exactly

corresponds with the sum of its constituting parts. Obeying to a principle called

by Langton “principle of superposition”, linear systems may be studied with a

reductionistic method. The system is divided into simpler parts, whose

understanding is enough in order to understand how the system works

as a whole. In this case it is possible to say that the system is “just”

complicated.

Non linear systems do not respect the superposition principle: even if the

observer has understood how each part works, it won’t be possible for him to

understand the system as a whole. This kind of system is complex. The

fundamental difference between a complicated and a complex system is the

importance of connections between parts, which would fail if parts are considered

separately.

Dealing with a system presenting this kind of features, the research

method has to be deeply revised in comparison with the analytical tradition.

Instead of starting from the system as a whole in order to decompose it and

understand its parts, it would be more opportune to start from its constitutive

parts.

Complex systems show other properties, such as emergence. If we define each

part’s internal and interaction rules, the outcome of the system as a whole

may be different from the bare sum of its parts. Coherent behaviours

not defined a priori may spontaneously come out from the aggregate

dynamics. A property is defined emergent if it clearly results from the

behaviour of the system, even if it has not been defined before in its parts’

rules.

The need to study complex system “bottom-up” lead to the diffusion of agent

based simulations methods, where agents are comparable to what has since

defined parts. For a thorough analysis of agent based simulations in social science,

economics in particular, we refer to Gilbert and Terna (2000) and to Tesfatsion

(2002) .

Following Parisi (2001):

Simulations carry out a synthesis of reality, where synthesis

means starting from elements to study how they interact and

the emergent behaviour. A simulation stems from a group of

components of a system and, through the elaborations of a

computer, shows how the interactions between elements yield

to the overall system with its specific properties. Simulations

are based on the assumption that reality can’t be explored just

through the analyses of its components, but is necessary to rebuild

it beginning from its constructing components.

Simulation models are methods used to comprehend reality halfway between

models expressed by language and mathematical symbols. Mathematical models

appear to be too much rigid, as they don’t allow to adequately highlight the

behaviour of parts composing the model without overloading them exceedingly

complex rules. Verbal models are suitable to be more flexible, but are unfit for

providing quantifiable results: even if they overtake the rigidity of mathematical

models, they are surely less rigorous.

A simulation model does not use words or mathematical symbols: the

phenomenon is described with a formal language suited for the computer. The

computer does calculation and provides the results for the experiment. In

this way the computer works like a sort of virtual laboratory through

which the scientist can verify his hypotheses, manipulates variables and

constraints of the model and afterwards observes the outcome on the

screen.

4.2 Overview of the model

The empirical part of the paper is an agent based simulation model that

tries to describe the economic law that lead the enterprise into an

innovative process. The model describes how the innovations are created

and the dynamics of knowledge spreading to other enterprises via

imitation .

From a technical point of view we use Swarm (http://www.swarm.org) as

agent based simulation framework to develop the model and implement it in Java

(http://java.sun.com). Swarm has been chosen because of its diffusion and the

presence of a strong community of users; we believe is very important to create a

model easily understandable by other scientist and Swarm is somehow a base

framework. In order to visualize the simulated world of firms and customers

interconnected, the library Jung - Java Universal Network/Graph Framework

(http://jung.sourceforge.net/) has been used.

The simulation represents the economic world using two different populations

of agents:

- firms

- consumers

The focus of the model is the enterprise which is the potential innovator:

consumers define a competitive environment for the enterprises in order to push

them into an innovative process.

In the definition of innovation (or better “innovative process”) we refer to the

field of study leaded by Schumpeter. We consider the innovation as a relational

good, and we will show that the innovation’s value emerges from the interaction

between firms and consumers. We refer to innovation as the process of

discovering something new; we refer also to the imitation process that

is crucial in order to spread knowledge in the economy trough a social

network.

We focus especially on two theoretical concepts.

- the role played by the tacit knowledge in the innovative process. This

kind of knowledge is transferable only by face-to-face relationship via a

non codified transmission. Tacit knowledge is idiosyncratic of a specific

time, place and group of people.

- social relations are expensive in term of time and effort both for

firms and for consumers; in order to draw a social network we try to

justify the all the relations in terms of competitive advantage or higher

knowledge obtained by the members.

The goal of the simulation is to build a model useful to understand the

innovation process from two different points of view.

- From a micro perspective we investigate:

- why the firms decide to innovate;

- how the innovation process affects the enterprise’s activity;

- how innovation spreads via imitation.

- From an aggregate perspective we look for emergent phenomena coming

from the interactions of the simple agents described in the model, the firms,

and we investigate:

- innovations and imitations affect on the economy as a whole;

- business cycles dynamic of the simulated economy;

- technological progress dynamic at a macro level: is it constant or

does it shows, jumps, radical innovations followed by incremental

ones?

4.3 The consumer side

Consumers define the environment for the enterprises but they are not

object of analysis. Consumers have heterogeneous preferences and bounded

rationality.

4.3.1 Consumer with heterogeneous preferences

The preferences of the consumers are defined by a numeric array, each value of

which is a “feature” of the product that the consumer would like to have. Every

consumer has its own preferences randomly generated at the beginning of

the experiment using an array of integers with a length defined by the

initPreferenceLength parameter. The domain of each value is defined by the

parameter preferenceDomain. For instance a consumer preference could be

defined as a 3 digit string using an alphabet of 12 possible values for each

digit.

![[11;0;3]](innovation3x.png)

Every consumer looks for a product as much similar as possible to its

preference.

4.3.2 Consumer and bounded rationality

For a theoretical perspective on bounded rationality in economics we refer to

Ludwig von Mises (1949) and Camerer (2004). The bounded rationality

of the consumer is modelled using a social network; the consumers are

vertex of a graph and are connected with the enterprises via undirected

edges. If a consumer is connected to a firm with a edge it means that the

consumer knows that firms and, most important, she knows the product

offered.

The edges between consumers and enterprises are dynamics and are

modified during the simulation as described in the section referring to

the dynamics of the system. The consumer buys one product at every

tick and she chooses the one closest to her preferences among the known

products.

4.4 The firm’s side

4.4.1 The technology is embedded in the products

Each firm produces one product, represented by a numeric array of a defined

length. Each value of the array represents a technological feature of the product:

in this way each product is potentially different from each other product. The

parameter initProductsLength defines the initial length of the products for all the

firms. When the simulation starts each firm is characterized by a product defined

by many features chosen randomly within a domain defined by the parameter

featureDomain.

For instance a product could be defined as a 4 digit string using an alphabet of

12 possible values for each digit; in this case a possible product would

be:

![[1;11;0;3]](innovation4x.png)

4.4.2 The financial aspects, a basic accounting framework for the

firm

The firm has a basic accounting capability; the firm has an initial asset defined by

the parameter initialFirmAsset and at every tick of the simulated time the firm

faces costs and revenues.

Costs are divided in:

- fixed costs, defined by the parameter fixedCost; they are subtracted

from the firm’s asset at every tick. All the firms pay the same fixed

costs;

- variable costs; they are due to the innovative process and are paid

only if the firm decides to innovate. There are two type of variable

costs:

- cost for internal research: in case the firm decides to innovate

investing in research a parametric defined cost researchCost is

charged, this is generally an high cost;

- cost for imitation: in case the firm decides to imitate another firm’s

product a parametric defined cost imitationCost is charged, this

is generally a low cost.

The revenue comes only from selling activity: when a firm sells a product, it

earns a predefined amount of money. The revenue depends only on the number of

products sold.

4.4.3 Internal research and imitation: the innovations strategies

The firm has also an innovation strategy; firms can have a vocation to imitate or

to be engaged in internal research. Each firm’s innovation strategy is decided

randomly (with 0.5 probability from a normal distribution) at the beginning

of the simulation. At every tick the firm decides its innovative strategy

according to its vocation; an “imitation strategy” firm will always innovate by

imitation and a “research strategy” firm will always use internal research to

innovate.

4.5 Model’s dynamic

4.5.1 The environment in which firms and consumers interact

Firms and consumers are connected each other within a social network. The

network is defined topologically as a graph with vertex (firms and consumers) and

edges (their relations). This is a relational space and not a geographical or

physical space.

Firms are connected among them using a  small world graph as defined by

(Watts, 1998) and their edges are static. This kind of model has been chosen for

its statistical property (it shows “Small Worlds” properties) as described in

chapter 3.

small world graph as defined by

(Watts, 1998) and their edges are static. This kind of model has been chosen for

its statistical property (it shows “Small Worlds” properties) as described in

chapter 3.

The connection between firms and customer is dynamic, evolves over time, and

is defined randomly with a given probability. The formalization of the ties

between firms and consumers is randomly generated at the beginning

of the simulation and refreshed every n tick where n is defined by the

parameter edgeUpdateFrequency. At every refresh the following algorithm is

performed:

- for every consumer the existing edges are destroyed with a probability

p1 defined by the parameter edgeDistructionProb;

- for every consumer, excluding the existing edges not destroyed in phase

1, new edges are created using a probability p2 and testing it for every

possible link between a customer and all the existing firms; p2 is defined

by the parameter edgeCreationProb.

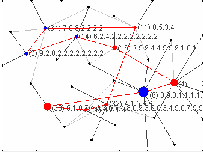

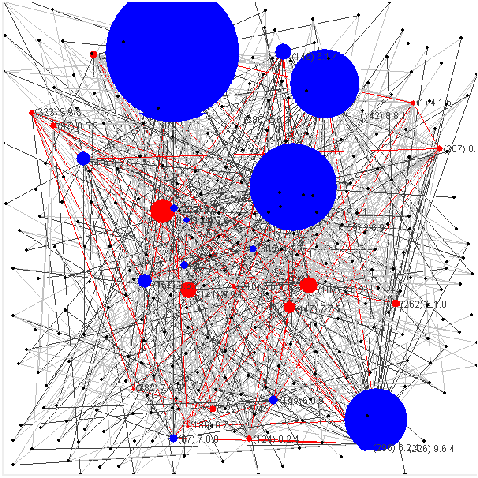

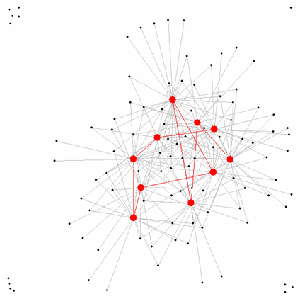

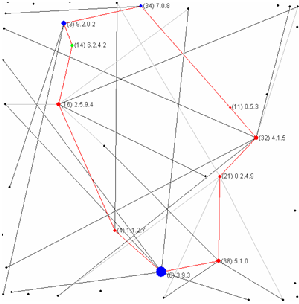

The figure 4 show a world with 100 consumer and 10 firms. The  model

connecting the firms has beta 0.1 and the graph degree is 2; the probability of

edge creation between consumer and firms is 0.2. To visualise the graph the

Fruchterman-Reingold algorithm has been used.

model

connecting the firms has beta 0.1 and the graph degree is 2; the probability of

edge creation between consumer and firms is 0.2. To visualise the graph the

Fruchterman-Reingold algorithm has been used.

4.5.2 Dynamics and interactions

Each consumer looks for the best product to buy selecting among the firms she

knows, then chooses the product that better fit its preference. At every

simulation’s tick each consumer buys one product ad generates revenues for the

selling enterprise. In order to choose the better product, the consumer compares

her preferences with all the products she knows and chooses the one that has

more common values. For example consider a consumer preference and 3

products:

![Consumer pref erences [1; 3;7]](innovation6x.png)

![P roduct 1 [5;9;1;4] ==> 1 match](innovation7x.png)

![P roduct 2 [6;9;7;5;7;1;2;3] ==> 4 match](innovation8x.png)

![P roduct 3 [2; 11;4;8;3;1;10; 5] ==> 2 match](innovation9x.png)

Product 2 will be chosen and bought by the consumer. It is easy to see that

longer features strings have higher probability to be chosen; if we remember that,

starting from an initial length equal for all the products, firms can add features by

innovation, it is easy to understand how we model the competitive advantage

given by the innovation.

The network graph shows relations among firms and between firms and

customers. The firms are connected among them by red edges. The firm’s vertex

colour depends on the strategy used by each firm to innovate. Blue vertexes are

imitators and red vertexes are innovators. When a firm innovates, it becomes

green.

The numbers displayed next to firm’s vertexes show the firm’s identification

number, in bracket, and the feature of its product.

The customers are gray vertex and they are connected to the firms by

gray edges. Each customer knows only the firms which is connected to

by an edge and at every tick decides to buy from one of the firms he

knows. The link connecting the consumer with the firm she buys from

changes its colour into dark gray, while all the other edges remain light

gray.

4.5.3 The innovative process

Innovation, when occurs, adds a value to the product features string,

according to the strategy used by the firm to innovate. We have two possible

strategies:

- internal research: if the enterprise decides to innovate through internal

research pays the amount defined by the parameter internalResearchCost.

The research activity will then give a result with the probability defined by

the parameter discoveryProb (about 0.8). We have two possible

scenarios:

- internal research gives no results: the firm pays the cost for

research and has no benefit at all;

- internal research is successful: the firm pays the cost for research

and then adds a new feature (number) to its product (array of

values). The feature is randomly chosen within the domain.

- imitation: if the enterprise decides to imitate, it pays the cost of imitation

defined by the parameter imitationCost. In order to imitate, the firm looks

to the products of the other firms it knows (which it is connected to in the

network). The firm then chooses the feature most diffused among its

neighbours and adds it to its product’s feature list. If two or more features

have the same diffusion within the neighbours one is chosen randomly. As an

example the following graph shows the firm number 14 (the green one)

imitating the feature “2” from its neighbours (firms number 3 and

16).

![Firm 3 [9;2; 0;2]](innovation12x.png)

![F irm 16 [2;5;9;4]](innovation13x.png)

![F irm 14 [6;2;4;2]](innovation15x.png)

Usually imitation is cheaper than internal research and is more efficient in

the model, as it outcomes with a certain result while research is only

probable.

Innovating, and then adding features to the products, gives to the

innovative enterprise a competitive advantage: its product is more likely

to match consumer’s preferences and then will probably sell more. The

firms that perform internal research discovers something new that can

provide competitive advantage regard to other firms in satisfying customers’

preferences.

The main issue is: when the enterprise decides to innovate and why?

According to Schumpeter we believe it happens for a competitive reason; the firm

looks for higher profit or better performance. In accord to this theory we define

two possible rules that lead a firm to innovate:

- no past sell: a firm innovates if in the last tick it sells nothing. If the

firm sells nothing it is probable that its product is not satisfactory for

the consumers;

- low market share: a firm innovates if its asset is lower than the 70%

of the average asset of the neighbouring firms. If the firm connected

have higher assets it means they sell more and that the market gives

the opportunity to increase the revenue by finding a better product.

An obvious conclusion is that innovation will lead to better economic

performance.

It is important to remember that the kind of innovation (imitation or internal

research) used by each firm is decided by its vocational innovative strategy as

described before.

5 The outcomes of the model

From an aggregate point of view many aspects could be analysed using the data

generated by the described model. In this section we would like to focus

on:

- real business cycle in the simulated society;

- technological progress trend within the simulated society;

- innovation diffusion process.

5.1 The emergence of real business cycle in the simulated society

As a fist example we outline how a very simple configuration of the model

provides a synthesis of the overall features. We see that firms are involved into the

innovative process, relationships between enterprises and customers are activated;

moreover, this experiment shows how an aggregate cyclical behaviour

emerges.

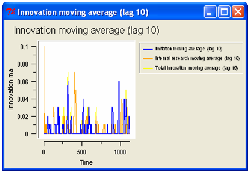

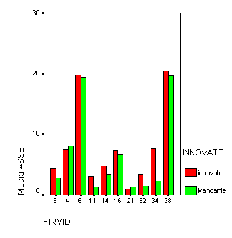

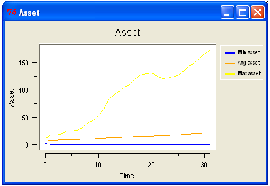

In the example shown in Figure 7, the network is populated with 30 customers

and 10 enterprises. Fixed and research costs as well as sell revenues are very low

(respectively 1, 3 and 1) and the simplest innovation decision criterion is

implemented (firms innovate if in the last time step no sell occurred)

.

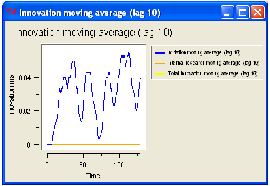

First of all, innovation occurs: enterprises do innovate (numbers/features

are added to the simple string describing their products), via internal

research and via imitation. This is clearly visible through the dynamics

of products array length shown on the graph and through the value of

innovation moving average. The effect of relationships on imitation is

clear, as the most diffuse feature will be reproduced into the imitating

neighbourhood.

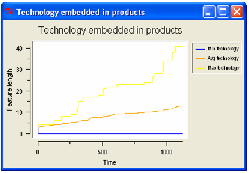

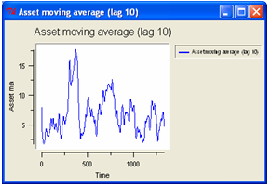

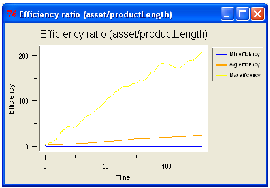

The technological progress is represented by the average length of the products

features. The graph on the left shows the maximum, minimum and average length

of the features; the graph on the right is a measure of efficiency of the

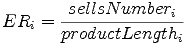

technology in economical terms. The efficiency ratio for the firm i is computed

as:

The trend is upward sloping and it shows how the simulated society is

innovating constantly over time.

It is easy to verify that innovation gives to the firm a competitive power, that

is expressed in term of a higher asset. The graph shows the average asset of each

firm when it decides to innovate and the average asset when the same firm is not

innovative.

Consumers, in this simple example, effectuate their buying decision comparing

the products offered by the different firms which they are connected with. Links

are activated at each time step and some firms have notable growth of

their asset (the size of the circles, which describe firms on the graph,

grows).

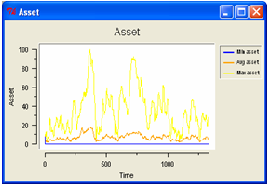

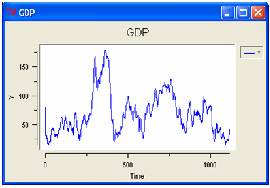

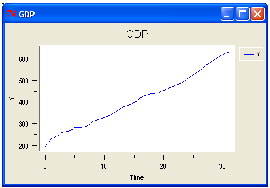

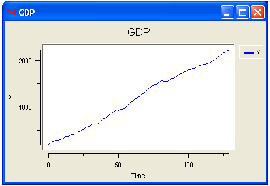

The Figure 10 shows a growth path generated by the model described. The

graph on the left shows the maximum, minimum and average asset owned by the

firms; the right one displays a moving average with lag 10 tick of the asset of the

firms.

There are clear cycles, that could be conduced to the real business cycle

theory: the expansion phases are followed by contractions. It is possible to identify

big shifts and small adjustments alternated. Also the gross domestic product of

the simulated economy confirms this outcome.

5.2 Endogenous growth and monopoly

This second configuration

tries to figure out the impact on the simulated economy as a whole of the

innovations made by the enterprises. The effect of the innovations, within this

framework is continuous growth.

The growth of the economy is not created exogenously by a parameter but it is

endogenous and comes from the firm’s interactions. Consumers in the model do

always buy firms’ products: they only decide which product to buy among the

enterprises which is connected to. In this experiment we see how a big number of

consumers provides firms the opportunity to grow their assets through sells

and we will investigate if monopolistic behaviour is coherent with the

model.

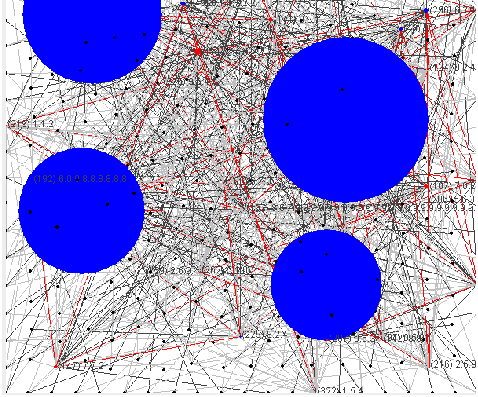

The number of consumers is much higher than the number of firms (30 firms

and 300 consumers): the model shows (ceteris paribus) a behaviour coherent with

its construction, a condition of continuous growth, in firms’ asset terms and for

aggregate mean assets too (Figure 11).

The growth is not homogeneous among firms(Figure 12); some of them, the

most innovative ones, grow faster than others; this difference is due to the

competitive advantage given by internal research, imitation or links with

consumers, that let them gain a major share of the market.

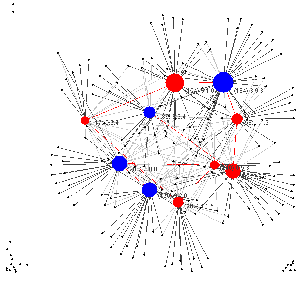

5.3 Research and imitation

An important feature of the model, in the theoretical framework we outlined at

the beginning of this paper, relates to the relational basis of the decision of

firms to commit into the innovative process. In this simulation criterion

1 is selected: a firm decides for innovation if its asset is lower than the

70 per cent of the average asset of its neighbourhood. In the simulation

the

effects of this criterion are fully evident in Figure 13: first of all, when just four

firms out of 30 demonstrate very high levels of their assets and all of them are

imitators, neighbouring firms do regularly choose the innovative process (via

imitation or internal research).

The aggregate behaviour is similar to the imitation process described in

Schumpeter’s works: when a firm achieves a competitive advantage in the market,

reaching a sort of monopolistic position, other entrepreneurs are aware of profit

opportunities and get into the innovation-imitation process. Even if the profit of

the quasi-monopolistic enterprise do not lower sensibly in the simulation, the

aggregate asset of firms grows, as imitators’ assets do as shown in Figure

14.

The smaller firms try to fill the competitive gap by innovating regularly, in

this way, if they are imitative for vocation, contribute to the spread of the brand

new technology created. The dynamics of the innovation is shown in the Figure

15.

6 Conclusions

In the previous section we described how the simulation model provided some

useful insights for our understanding of firm innovation. Overall, the model shows

how we can obtain coherent aggregate dynamics through the description

of the only rules concerning parts, that in our example are firms and

consumers. Computer simulation generates complex aggregate phenomena, such

as innovation diffusion and business cycles: no description of the rules

proper of this “macro” level was needed, ad it emerged out from bottom-up

dynamics.

We started our work from some theoretical deepening of economic

literature on innovation; some insights on the nature and role of knowledge in

entrepreneurial activity were useful to circumstantiate the subject of the

simulation model. Relational aspects of innovation seemed to be more interesting

and suitable to start the development of a simulation framework, which would be

useful from both the point of view of an economist and a geographer. We then

explained how graphs and social network theory could be adequate in order to

formally describe relationships between firms and consumers. We finally tried

to implement coherently this theoretical framework into a simulation

model.

The first results presented here seem to be encouraging as the main

fundamental features that the model was expected to present did actually

demonstrate to work correctly. First, a competitive market emerges: firms are

forced into innovative processes by the push effect of consumers and we can say

that the model presented has and endogenous growth force. The effect of

relationships and the main properties of the network implemented in the model

produce the expected outcome: innovation (in particular when imitation occurs)

in firms is influenced by the conditions of their neighbourhoods. In general terms,

“proximity matters”. Moreover, some unexpected properties emerge, such

as the formation of cycles and, under certain conditions, monopolistic

markets.

The encouraging results briefly summarised concur to imagine the provision

for a follow-up of our work and future development of the model. First of all, more

and more experiments should be done and new sets of variables have to be tested,

in order get more validations of the model. Moreover the main issue for future

developments will be the implementation of geographical space, beyond that

relational one. In this future research, the use geographical information systems

(GIS) will be fundamental, in particular with an integration between GIS

and simulation software. The combined use of Swarm and some open

source GIS will probably solve much of unsolved technical and theoretical

issues.

References

Cowan, R., & Jonard, N. (1999). Network structure and the diffusion of

knowledge. MERIT Research Memorandum(99-028).

Gilbert, N., & Terna, P. (2000). How to build and use agent-based models

in social science. Mind & Society, 1, 57-72.

Hayek, F. A. (1937). Economics and knowledge. Economica(IV).

Langton, C. (1992, agosto). Vita artificiale. Sistemi Intelligenti, IV (2),

189-245.

Parisi, D. (2001). Simulazioni. la realtÓ rifatta nel computer. Il Mulino.

Polanyi, M. (1967). The tacit dimension. Routledge and Kegan, London.

Schumpeter, J. (1934). The theory of economic development: An inquiry

into profits, capital, credit, interest and the business cycle. Harvard

University Press, Cambridge Mass.

Tesfatsion, L. (2002). Agent-based computational economics: Growing

economies from the bottom up. ISU Economics Working Paper(1).

Watts, D. J. (1998). Small worlds: The dynamics of networks between

order and randomness. Princeton Studies in Complexity.

= 0.1 and the degree = 2.

= 0.1 and the degree = 2.

![[11;0;3]](innovation3x.png)

![[1;11;0;3]](innovation4x.png)

![Consumer pref erences [1; 3;7]](innovation6x.png)

![P roduct 1 [5;9;1;4] ==> 1 match](innovation7x.png)

![P roduct 2 [6;9;7;5;7;1;2;3] ==> 4 match](innovation8x.png)

![P roduct 3 [2; 11;4;8;3;1;10; 5] ==> 2 match](innovation9x.png)

![Firm 3 [9;2; 0;2]](innovation12x.png)

![F irm 16 [2;5;9;4]](innovation13x.png)

![F irm 14 [6;2;4;2]](innovation15x.png)